Flavor And Innovation Trends In Australian Chocolate Launches – 1H 2025

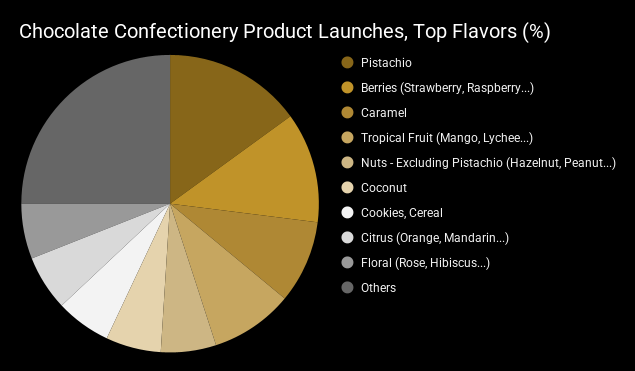

In the first half of 2025, an analysis of chocolate products launched in Australia revealed clear trends in flavor and texture. Pistachio led as the most featured ingredient, followed by berries and tropical fruits. Brands also emphasized crunchy elements to enhance sensory appeal. This article outlines the key flavor and innovation trends shaping the Australian chocolate market during this period.

Pistachio Anchors Chocolate Innovation

Pistachio dominates the Australian chocolate market in 2025, representing over 15% of product launches from January to June 2025 with its rich, nutty profile appealing to consumers seeking premium, sophisticated flavors. Margaret River Fudge Factory’s Pistachio with Knafeh & Gourmet Milk Chocolate Bar blends pistachio with crunchy knafeh, aligning with the viral “Dubai chocolate” trend while Poppy’s Chocolates launched a slew of pistachio options including Pistachio Knafeh Bliss Block and Pistachio Egg Block (which incorporate tahini for depth), while its Pistachio Coconut Bunny adds a tropical twist. Lindt meanwhile, among the top DTC players in Australia rolled out their Dubai Style chocolate bar featuring creamy milk chocolate with pistachio. These launches underscore pistachio’s pivotal role in driving innovation in the high-end chocolate segment.

Berries Deliver Vibrant Flavor Profiles

Berry flavors, encompassing raspberry and strawberry, account for over a tenth of launches, offering tangy, vibrant profiles that enhance chocolate’s richness. Manuko’s Raspberry Bites pair organic 70% Peruvian chocolate with a raspberry filling for a bold experience. Meanwhile Aero’s Strawberry Bar provides a lighter, choco-bubble texture. These products highlight berries’ versatility in appealing to both premium and mainstream consumers.

Tropical Fruits Expand Exotic Offerings

Tropical fruit flavors including lychee, pineapple, and mango, reflect demand for exotic, refreshing profiles. Poppy’s Chocolate’s Easter Egg Block Lychee blends creamy milk chocolate with freeze-dried lychees for a sweet-floral note, while its Easter Egg Block with Freeze-Dried Pineapple offers a tangy contrast. Meltdown Artisan’s White Chocolate Mango Jelly with Macadamia Tonka Praline, pairs mango’s vibrancy with nutty praline, enhancing complexity. These launches demonstrate how brands leverage tropical fruits to create innovative, seasonal products that attract adventurous consumers.

Crunchy Elements Add Textural Complexity

A key trend observed in 1H 2025 launches is the intentional inclusion of crunchy elements, enhancing indulgence beyond just flavor. Brands achieve this with various inclusions: KitKat's Honeycomb Smash Incredible Egg highlights honeycomb pieces, KitKat wafer chunks and rice crispies. Similarly, Poppy's Chocolate frequently uses crunchy kataifi and crunchy chips while Manuko, also an Australian brand, incorporates crunchy peanuts, chia seeds & activated buckwheat. This focus on diverse crunchy components creates a satisfying mouthfeel, contributing to the perception of a more complex and premium product, and meeting consumer preferences for dynamic sensory experiences.

The Premiumization Imperative: Driven By Quality Ingredients And Craftsmanship

Australia's chocolate market in 1H 2025 shows a clear drive toward premiumization, directly fueled by a sharp focus on ingredient quality and craftsmanship with brands moving beyond vague claims to specific sourcing to signal superior quality and build trust. Manuko highlights organic 70% Peruvian chocolate, Hunted+Gathered specifies Dominican Republic cacao, and Meltdown Artisan uses Solomon Islands cocoa butter.